CATEGORIES

- ALL

- VIC

- QLD

- SA

- NSW

All Categories

Home Design Inspiration

Home Finance Tips

Home Building Tips

Knockdown and Rebuild

Latest News and Burbank Updates

Property Insights and Investments

Home Building Master Class

All Categories

Home Design Inspiration

Home Finance Tips

Home Building Tips

Knockdown and Rebuild

Latest News and Burbank Updates

Property Insights and Investments

Home Building Master Class

How tax cuts can help you into your new home quicker

On July 1, the Federal Government’s new Stage 3 tax cuts started, putting much needed cash into pockets, but also significantly boosting the purchasing power of those looking for a new home.

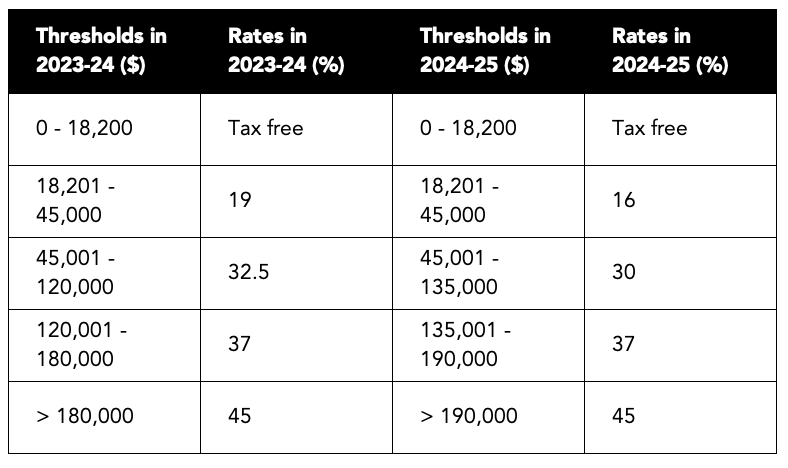

The tax cuts reduce the 32.5 per cent tax bracket down to 30 per cent and increase the 37 per cent threshold from $120,000 to $135,000.

(Source: Federal Gorvenment)

Additionally, the 45 per cent threshold is being increased from $180,000 to $190,000, and the lowest tax bracket drops to 16 per cent, from the current rate of 19 per cent, for those earning between $18,000 to $45,000.

Individuals earning above $120,000 will see the most substantial tax cuts due to the flattening of the tax brackets and the increase in the threshold for the highest tax rate.

The tax cuts, announced in the May Federal Budget, will enhance the financial capabilities of prospective homebuyers, giving them more leverage when entering the property market.

Homebuyers earning $96,000 will get a $20,000 boost to their budgets as banks factor them into borrowing capacity. For couples, both earning the same wage, it could mean a $40,000 boost.

For many couples it means they may be able to afford a home in areas that were previously out of reach.

For a single person, their borrowing power will increased by $16,000 to $380,000 this financial year, and their purchasing power has risen by $20,000 to $475,000, providing they have a 20 per cent deposit.

For couples where one earns the state’s average income and the other brings in half that, their borrowing power is increasing $23,000 to $616,000 and their purchasing capacity is rising $28,750 to $770,000.

For couples where both earn the average income, the tax cuts increase borrowing power by $32,000 to $876,000 and purchasing capacity is rising by $40,000 to $1.095m.

Many lenders were already factoring all these changes to the borrowing capacities of prospective buyers already. But impact of the tax cuts on lenders’ calculators may not be evident right away, as banks typically take about a month to update their systems following tax rate adjustments.

The increased borrowing capacity comes as the Federal Government starts its next 50,000 Home Guarantee places, in which the federal government guarantees home loans for market entrants and struggling single-parents.

This slashes the time needed to save a deposit, with applicants needing as little as 5 per cent of their planned purchase price, to make a move — and helps them avoid thousands in lenders mortgage insurance.